- Home

- Company

- Products

- Solutions

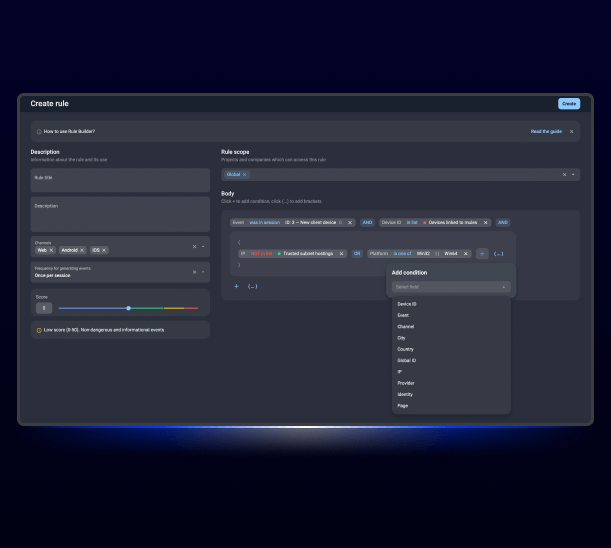

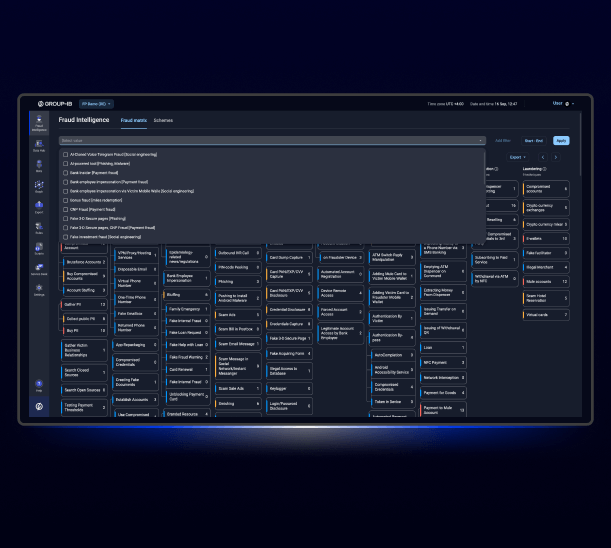

- Threat Intelligence Platform

- Threat Intelligence

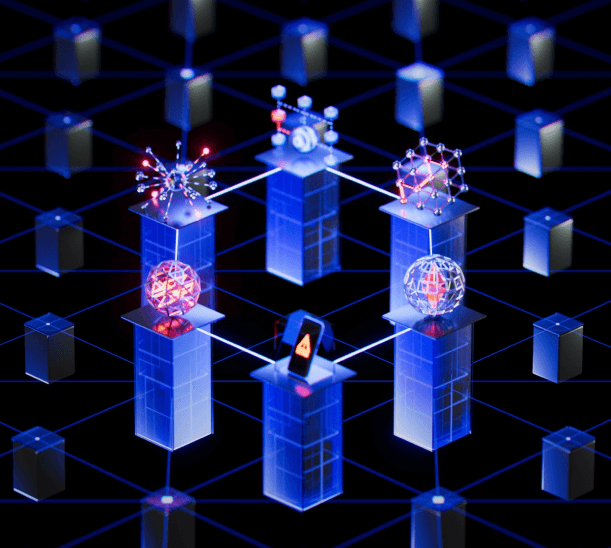

- Attack Surface Management

- Extended Detect and Response

- Endpoint Detection and Response

- Network Detection and Response

- Security Service Edge

- Zero Trust Network Access

- Endpoint Protection Platform

- API Management

- Next-generation Firewalls

- Mobile App Protection

- Promotions

- Events